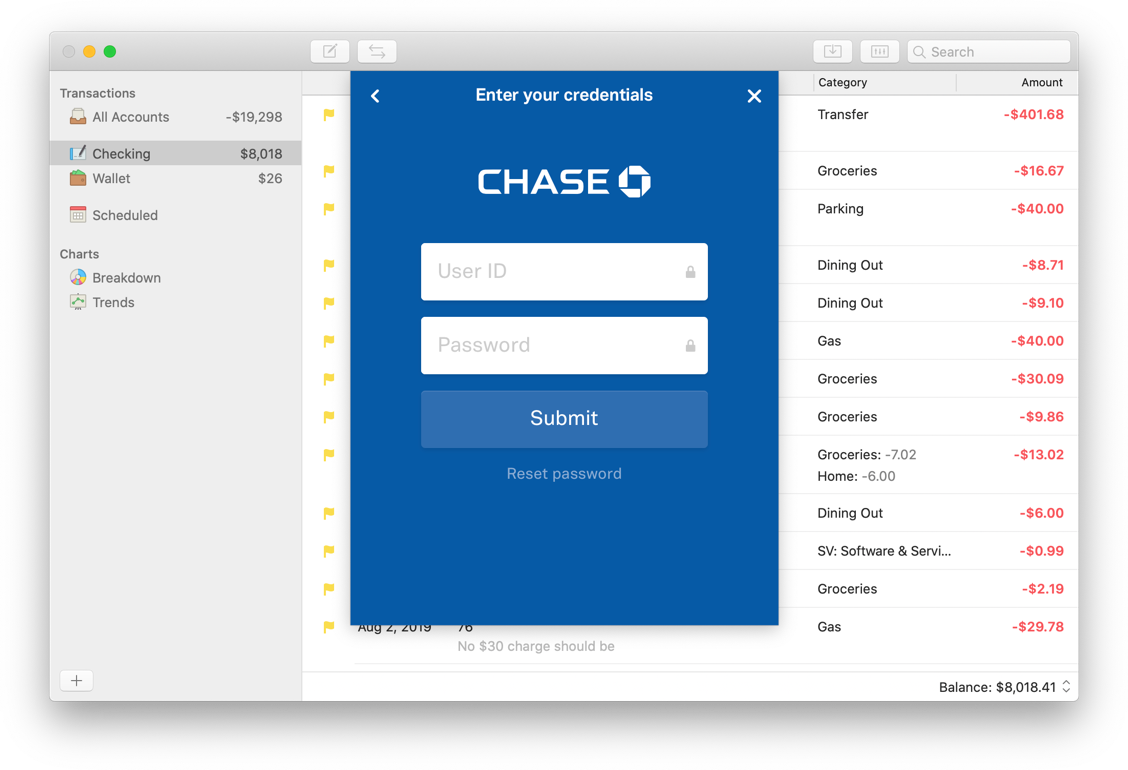

Bank Sync is here.

From the very beginning of creating Savings, the ability to automatically synchronize transactions with your bank has always been our vision. Today, we are happy to announce that Savings 2 can connect to all major credit cards in the U.S. and Canada, with support for more countries coming in the future.

With Bank Sync, you no longer need to manually enter every transaction. If you still like to manually enter some expenses, particularly big ones, Bank Sync automatically reconciles those transactions for you when sync takes place. It’s the same as if you manually import an OFX file, except with no effort on your part.

We have been using Bank Sync internally for the last several months, and it has completely changed the way we use Savings.

Secure Data Partner

To create Bank Sync, we partnered with Plaid to connect to banks throughout the U.S. and Canada. Plaid is the leading bank data provider for financial app like ours. By partnering with Plaid, we ensure your data is safe and secure.

Subscription

The use of Bank Sync is entirely optional and requires a separate monthly subscription. Monthly subscription starts at $2.99 per month if paid annually, and $3.99 per month if paid monthly. You can try Bank Sync risk-free for 30 days.

We think for less than the price of a cup of coffee a month, it’s well worth it.

Get Started

To setup Bank Sync, update to Savings 2.5 for Mac. Then, open Savings on your Mac and click the + button on the lower left corner of the window. You will see a new option to Sync with Bank.

Right now, you need to use the Mac app to setup Bank Sync. However, after set up, the iPhone app will download transactions while you are on the go as well. The ability to setup Bank Sync on iPhone is planned for the future.

If you don’t have Savings 2 for Mac yet, it is on sale now for $9.99 on the Mac App Store.