Getting Started with Savings

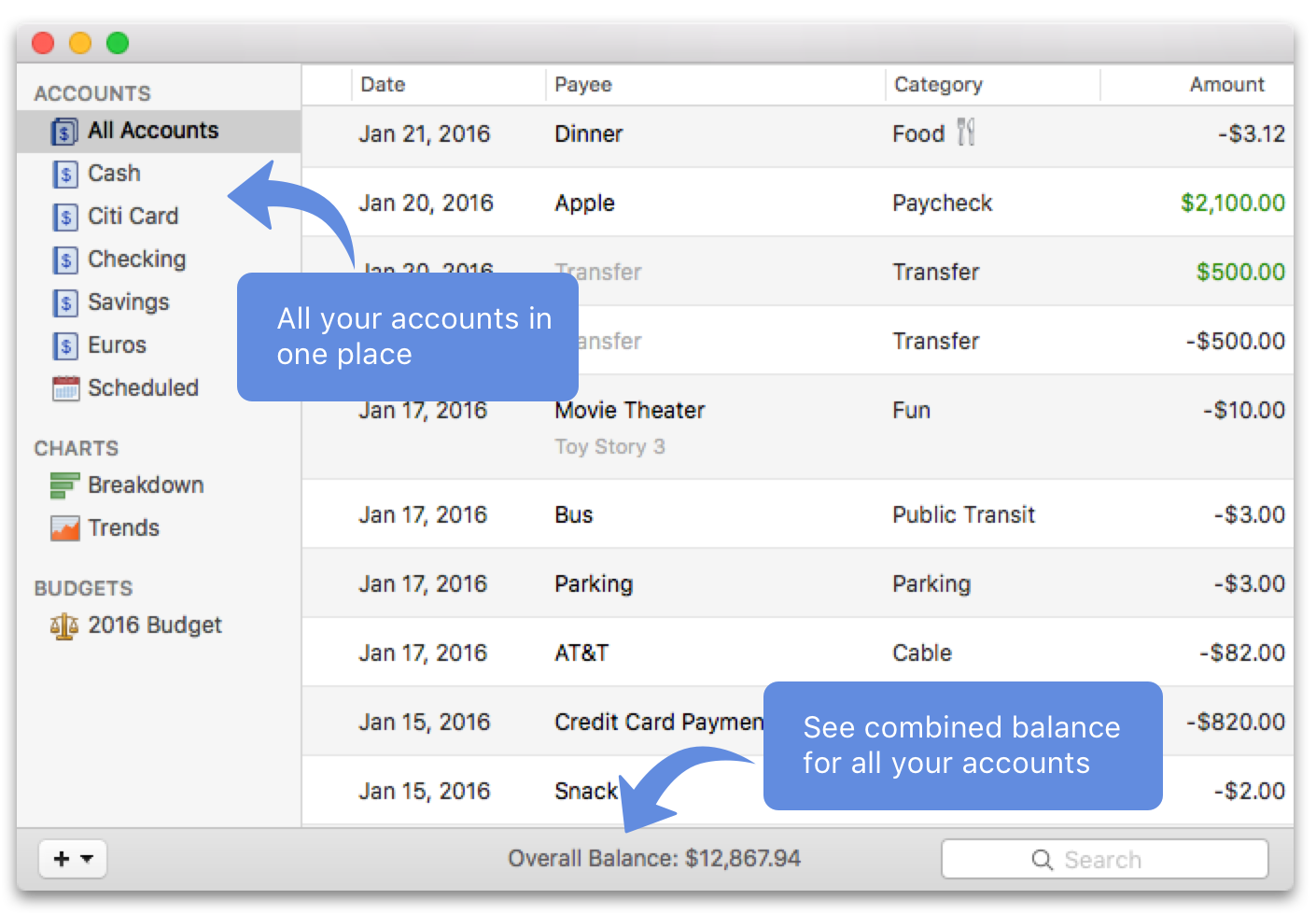

We all have accounts in real life: checking, savings, credit card account, you name it. The cash in your wallet can also be thought of as an account, as well as money you may have in foreign currency.

Savings, in the most straightforward sense, is an account management tool. It lets you bring all of your accounts into one place, so you can keep track of them easily.

As you spend money each day, enter them as transactions into Savings. Savings is your own record of what goes on in your accounts.

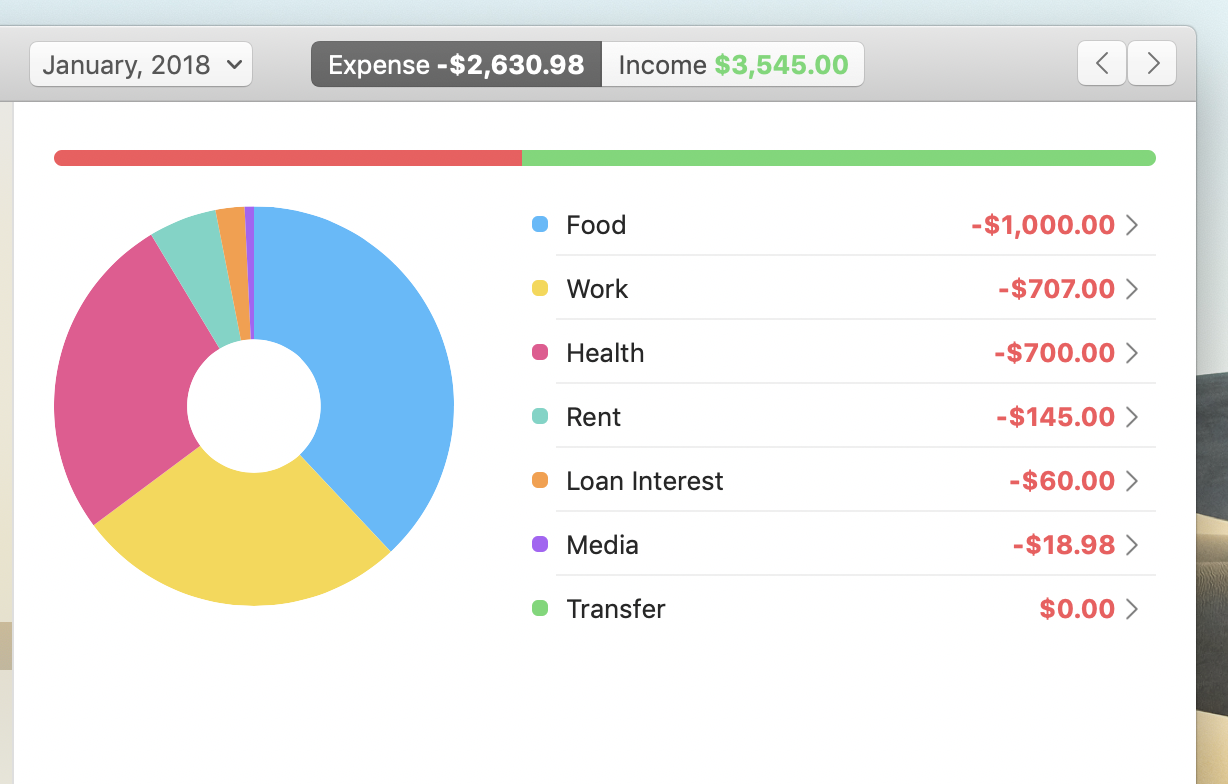

Categories

The reason you want to keep your transactions in Savings is because Savings lets you assign categories to them. Categories like “Food”, “Rent” or “Household”. By categorizing your transactions, you can begin to see where you are spending your money.

The insight you gain from seeing where your money go prepares you to create your first budget.

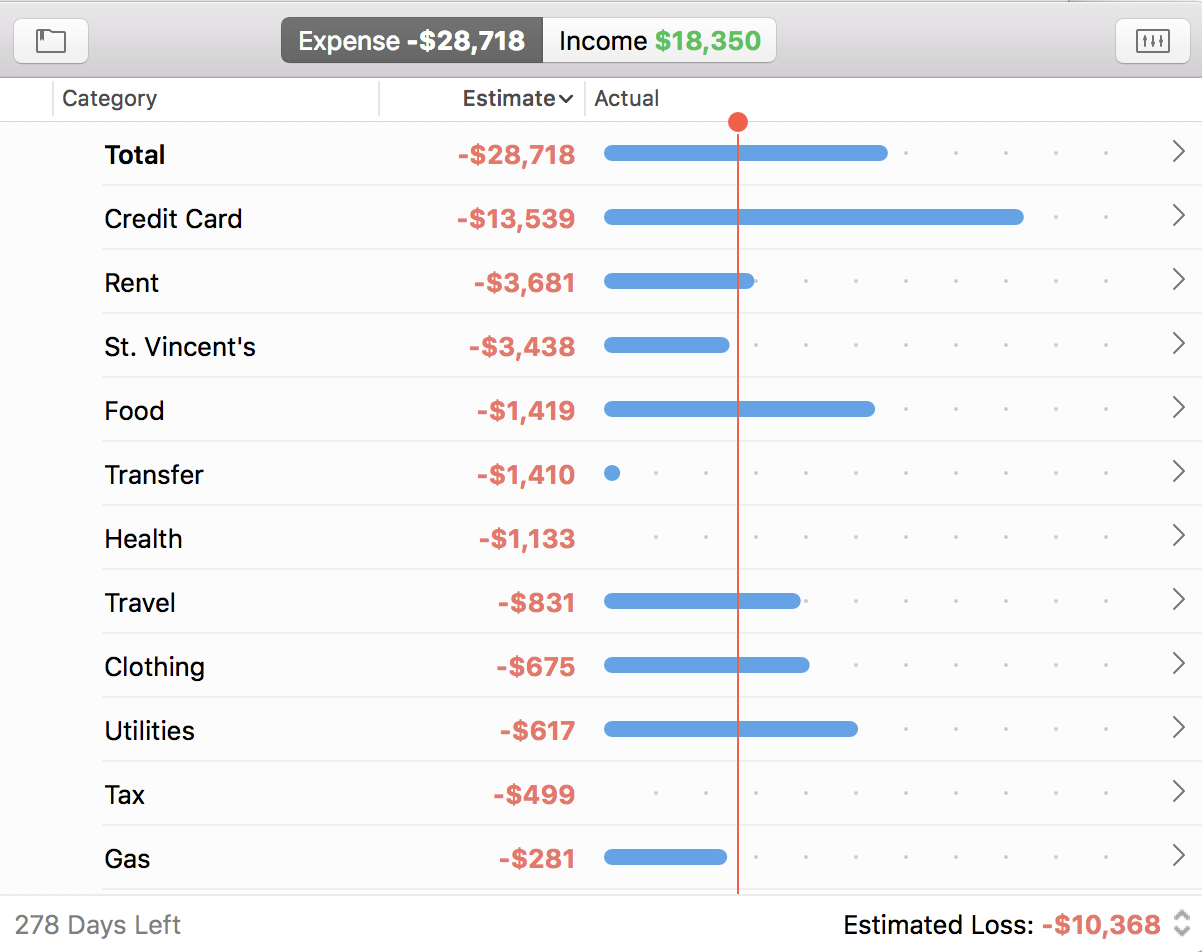

Budget

A budget is a plan of how you want to spend your money. Savings’ budget system is quite simple. You just set an estimate for each category of expense and income, and keep adjusting the budget to make the amount you save (income - expense) reach your goal.

It is best to budget for the entire year because some types of expense don’t occur on a monthly basis. Car payment or property tax are good examples of such expense. By budgeting for the whole year, you are essentially setting money aside for those expenses ahead of time.

But, if you are in a special situation where you can only budget for a few months at a time, Savings lets you do that as well.

This has been a quick tour of Savings’ features. You are now ready to begin explore Savings on your own. If you ever get stuck, refer back to articles on the support page, or contact us for help.