Reconciliation

Reconciliation is the process by which you make your account’s record match up with your bank’s. To help you keep track of what’s confirmed with bank record and what’s pending, Savings mark new transactions you enter with a yellow pending flag.

When you see that the transaction has appeared on your bank’s record, tap the pending flag to clear the transaction, making it official.

Note, for Cash account type, transaction is cleared by default, since there is no bank to clear with.

Cleared Balance

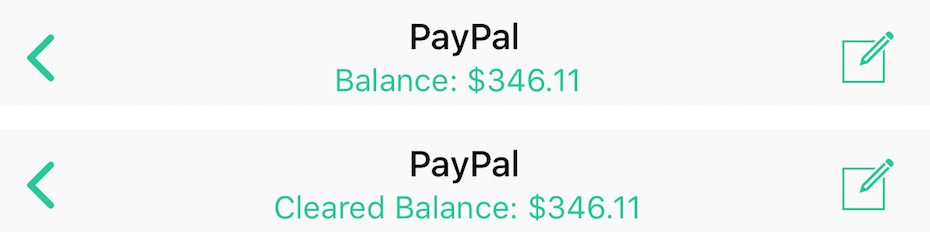

You can see the cleared balance of your account by tapping on the balance of the account.

The cleared balance shows you the balance of your account without pending transactions.

Manual Reconciliation

To manually reconcile your account:

- Clear pending transactions in Savings that you see in your bank’s record.

- Add missing transactions to Savings.

- Checked the cleared balance of Savings and your bank’s record to make sure they match.

Sometimes if the difference in balance is small and hard to spot, you can just add a transaction to adjust the balance. I typically call that transaction “Adjustment” with the category “Untracked”.

As for what bank record you use, it’s up to you. You can reconcile once a month using the statement you receive from your bank, or reconcile more often using your bank’s online banking activity view.

As you can imagine, reconciling by hand can be hard for very active account. That’s why Savings for Mac offers the ability for you to import transactions from your bank. The Import from Bank section discusses this in more detail.